|

|

|

|

|

IntellaTurn's Weekly Scoop

By Erin at IntellaTurn ● Dec 11, 2025

This week: Drug approvals | Biggest follow-on offering day in biotech history | ASH meeting highlights | Scientists’ blood saves babies from botulism

|

|

Axios Media

✅ Fondazione Telethon’s WASKYRA: First gene therapy for Wiskott-Aldrich syndrome

-

A genetic disorder that leads to bleeding episodes and life-threatening infections has a new FDA approved treatment, a regulatory decision that marks two notable firsts — the first gene therapy for this rare disease, Wiskott-Aldrich syndrome, and the first cell and gene therapy approval awarded to a non-profit entity.

-

The FDA decision covers Waskyra (etuvetidigene autotemcel or ‘etu-cel’ for short), for children age six months and older who have the mutation driving Wiskott-Aldrich syndrome.

-

These patients must also be eligible for a stem cell transplant but cannot get one because no matched donor is available.

-

The FDA said its review of Fondazione Telethon’s application “exercised appropriate regulatory flexibility.” This flexibility took into account considerations for the rare disease; clinical trial design; the mechanism of action of Waskyra; and the chemistry, manufacturing, and controls for the therapy, the agency said. (MedPage Today)

✅ Gamida Cell’s OMISIRGE: First cell therapy for severe aplastic anemia

-

The FDA approved Gamida Cell’s Omisirge (omidubicel-onlv), a cellular therapy made from modified umbilical cord blood, as the first haematopoietic stem cell transplant product specifically indicated for patients with severe aplastic anaemia.

-

The expanded label allows Omisirge to be used in adults and children aged six and older who require transplant following reduced-intensity conditioning, but do not have a compatible donor.

-

Omisirge uses donor cord blood stem cells that are treated with nicotinamide, a form of vitamin B3, to enhance their ability to engraft and restore blood and immune function.

-

The FDA based its decision on data from an ongoing open-label study in which 12 of 14 treated patients achieved early and sustained neutrophil engraftment, with a median neutrophil recovery time of 11 days. (FirstWord Pharma)

✅ BMS’ BREYANZI: Expanded approval as first CART-T for marginal zone lymphoma

-

With FDA approval to treat marginal zone lymphoma (MZL), Bristol Myers Squibb’s Breyanzi is the first CAR-T therapy in the indication, as well as the first CAR-T to reach the market for five different types of blood cancer.

-

The US regulator endorsed the one-time infused CD19-directed treatment for adult patients with relapsed or refractory MZL who have received at least two lines of prior therapy.

-

Breyanzi, which broke through in 2021 with a nod for large B-cell lymphoma, has also been approved by the FDA to treat mantle cell lymphoma (MCL) and follicular lymphoma (FL), as well as chronic lymphocytic lymphoma (CLL) and small lymphocytic lymphoma (SLL). (Fierce Pharma)

✅ USAntibiotic’s AUGMENTIN XR: First commissioner’s priority review approval for decades-old antibiotic

-

Months after kicking off its Commissioner’s National Priority Voucher program, the FDA issued its first approval under the scheme, to the antibiotic Augmentin XR, manufactured by the generics company USAntibiotics.

-

The review was completed in “just two months,” the regulator said in its news release, adding that the drug’s application “demonstrated clear alignment with . . . national health priorities by strengthening the US drug supply chain through enhanced domestic manufacturing.”

-

Augmentin XR’s approval, the FDA continued, will in turn help the US address antibiotic shortages.

-

Augmentin XR is an extended release formulation of a combination of the synthetic antibiotic amoxicillin and the β-lactamase inhibitor clavulanate potassium.

|

|

Investors buy up stocks in biggest follow-on offering day in biotech history

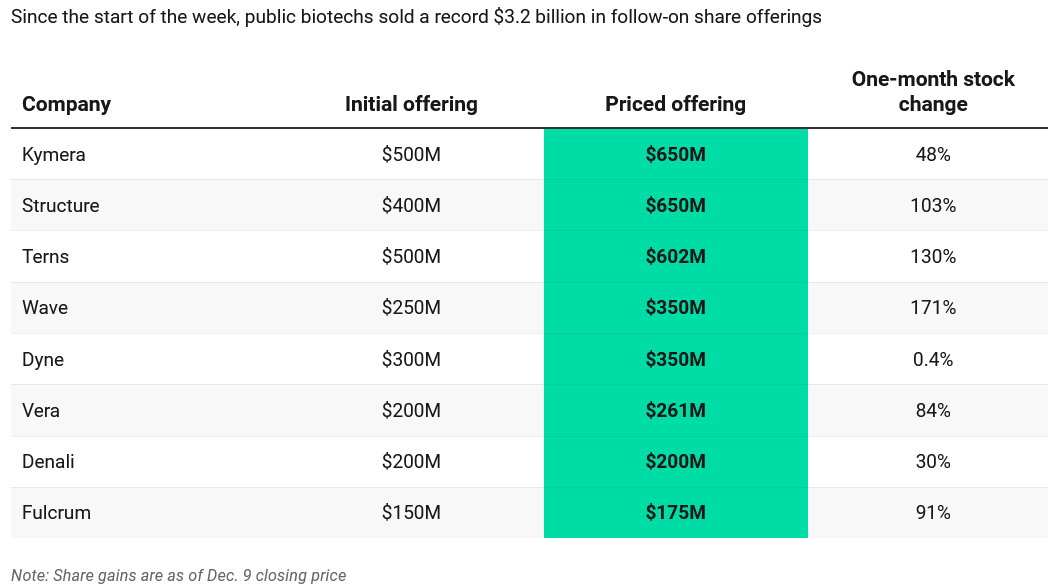

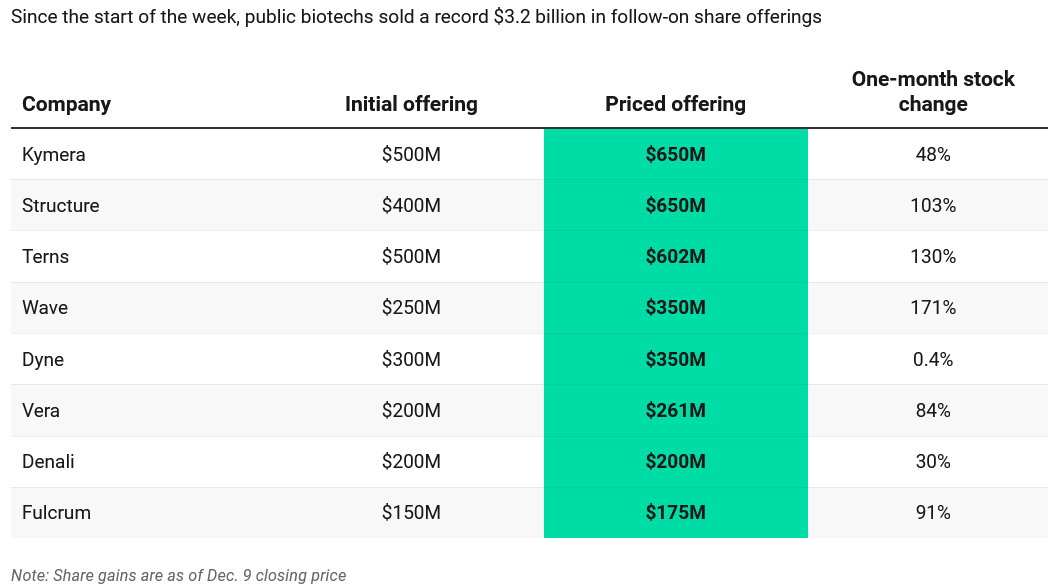

Table: Endpoints News. Source: Company filings and announcements

Record high: A record-setting $3.2 billion in biotech follow-on stock offerings were sold earlier this week, another indication of public investors’ appetite for the sector.

-

From late Tuesday evening into Wednesday morning, eight biotechs priced sales of new stocks, and seven of those companies increased their offering sizes to meet demand, with Structure Therapeutics, Terns Pharmaceuticals and Kymera Therapeutics each raising more than $600 million.

“$3.2bn of biotech equity issuance makes yesterday the busiest day ever,” said Jack Bannister, Leerink’s senior managing director in equity capital markets, who tracks company offerings.

“There have been busier weeks than this week, but yesterday was the busiest day ever,” Bannister said by email.

More details: The stock sales follow positive data readouts by the companies in obesity, sickle cell disease and leukemia.

-

Investors have been piling into companies with good data, hoping in part to ride an increase in M&A and licensing activity amid a dearth of IPOs where they might otherwise place bets.

-

And they reflect a rebound in biotech stocks to heights not seen since the Covid-19 pandemic.

-

The S&P’s biotech index, the XBI, is up 10% over the past month and 42% over the past six months.

Bigger than ever: Wednesday’s capital markets haul surpasses that of other big days in the history of biotech follow-on offerings. Two days in May 2020 each saw more than $2 billion in activity, according to Bruce Booth, a biotech investor at Atlas Venture.

Startups too: The positive momentum has also seeped into the startup world, with 27 megarounds disclosed since Sept. 30, according to an Endpoints News tally.

|

|

Highlights from the American Society of Hematology meeting

➡️ J&J’s ‘remarkable’ TECVAYLI data support earlier use in multiple myeloma

-

Johnson & Johnson announced new data from the investigational phase 3 MajesTEC-3 study that demonstrate the potential of TECVAYLI plus DARZALEX FASPRO as early as second line for patients with relapsed/refractory multiple myeloma.

-

Results show an 83% reduction in the risk of disease progression or death compared to standard regimens at nearly three-years follow-up, 95 percent confidence interval.

-

Ninety-one percent of patients who were progression-free at six months remained progression-free at three years.

-

The study evaluated the efficacy and safety of the investigational immunotherapy combination of TECVAYLI plus DARZALEX FASPRO versus DARZALEX FASPRO and dexamethasone with either pomalidomide or bortezomib in patients with RRMM who have received 1-3 prior lines of therapy. (Nasdaq/RTT News)

➡️ Terns’ ‘unprecedented’ leukemia data beats Novartis’ SCEMBLIX

“Unprecedented remains the only suitable adjective to describe the compound’s clinical profile,” William Blair analysts wrote.

-

The results for TERN-701 showed a double whammy of improvement over Novartis’ offering. The Phase I CARDINAL trial featured patients with previously treated CML, with the readout including 38 efficacy-evaluable participants.

-

Terns’ allosteric BCR/ABL1 inhibitor achieved an overall major molecular response (MMR) rate of 75% at week 24, while 64% of patients achieved the MMR. The data also supported daily dosing and had no food effect. (BioSpace)

➡️ Novartis details phase 3 win in primary immune thrombocytopenia

-

Novartis is divulging details from ianalumab’s summertime phase 3 win in a rare autoimmune blood disorder, and the data suggest the treatment could delay the progression of patients to more serious forms of the disease.

-

Patients with primary immune thrombocytopenia (ITP) given ianalumab alongside Novartis’ Promacta (eltrombopag) saw their low platelet counts boosted to safe levels for 13 months after treatment, compared to just 4.7 months for patients given eltrombopag and placebo, translating into an extension of ITP disease control by 45%.

-

The results from the trial, called VAYHIT2, were also published in the New England Journal of Medicine. (Fierce Biotech)

|

|

Interesting read: Drug made from scientists’ blood saves babies from botulism

iStock / Cultures Studio

Background context: The botulism outbreak tied to ByHeart formula has sickened at least 39 babies across 18 states since August — and showed the value of the treatment made from blood plasma donated by a small group of scientists and other volunteers.

“This is almost like a miracle,” said Dr. Vijay Vishwanath, a pediatric neurologist at Children’s Hospital Los Angeles, who has treated several children with botulism during his career — including one in the current outbreak.

“Prior to the discovery of BabyBIG, some of these hospitalizations would take two or three months,” Vishwanath said, if infected children recovered at all.

More details: Licensed in 2003, BabyBIG is the brand name for human botulism immune globulin, an IV medication that uses antibodies from volunteers vaccinated against botulism to help babies too young to fight the disease on their own.

-

The disease occurs when babies ingest botulism spores that germinate in the intestine and produce a dangerous toxin that attacks the nervous system.

-

The treatment was the brainchild of the late Dr. Stephen Arnon, who was a scientist with the California Department of Public Health. In 1976, Arnon and colleagues identified the rare form of botulism that affects infants younger than 1 — and then spent his 45-year career figuring out how to treat it.

Today: More than 3,700 children worldwide have been treated with BabyBIG since Arnon and his team conducted a pivotal clinical trial in California in 1997 that showed the medication could shorten hospital stays and reduce the need for breathing machines.

Production methods: Produced in small batches every five years, BabyBIG costs nearly $70,000 per treatment, according to the California Infant Botulism Treatment and Prevention Program, which Arnon founded. Under state law, fees from the sale of the drug are used only to fund the botulism program.

-

The medication relies on donors like Nancy Shine, a 76-year-old retired biochemist in California who was vaccinated against botulism because she worked with the lethal germ in a lab.

-

Arnon first recruited Shine and other scientists for the BabyBIG project two decades ago because their blood produced high levels of antibodies, the blood proteins that neutralize the botulism toxin.

“It’s probably the highlight of my career that I actually was able to participate in this project and donate plasma,” Shine said. “We made a product that could save infants’ lives.” (Los Angeles Times)

|

|

✨ Thanks for reading! ✨

🌐 About us: IntellaTurn, LLC delivers business-critical and timely information to biopharmaceutical companies and start-ups in the life sciences industry.

📧 Questions? If you liked this, but need more tailored business insights, get in touch about our curated daily, weekly, and bi-weekly newsletters.

Celebrating 10 years: 2015–2025

|

|

|

|

|

|

|

|